Outsourced Accounting

What do we cover?

From Bookkeeping (data entry, A/R, A/P) to Controller oversight to CFO (strategic planning, financing, and projections) we have a qualified team of accounting professionals at every level and at flexible hours as you need them month-to-month. We can adapt and grow with your business so you can focus on what you are best at and enjoy the most.

Tax Planning and Compliance

What is it?

Income tax planning for owners and their businesses is a coordinated effort that builds on the foundation of TAC accounting (Timely, Accurate, and Complete)

Tax compliance services, all at the federal level and in all 50 states, include:

-

Income tax returns, all business tax returns

and individual tax returns -

Payroll tax returns

-

Sales tax returns

Outsourced Accounting

Why outsource your accounting?

Having Timely, Accurate, Complete (“TAC”) accounting data is critical for entrepreneurs to understand how their business is performing and to make good decisions. “TAC” is also the foundation for STRIV: we provide the best tax planning service to minimize the owner’s tax liability.

Because business owners do not have time to recruit qualified accounting staff and then onboard, train, and manage them. Often their businesses are growing quickly and their accounting needs change often, making it more difficult to have the needed accounting staff.

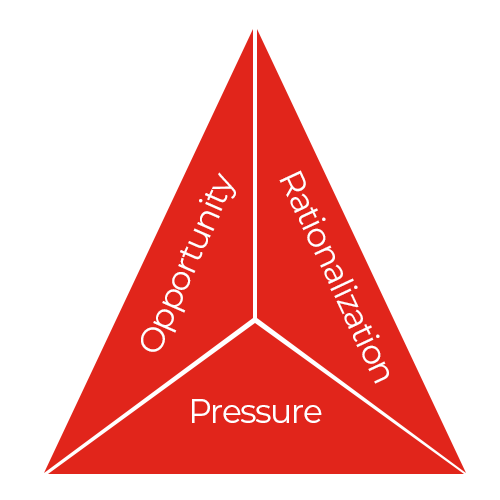

Having outsourced accounting oversight prevents embezzlement. It breaks the “fraud triangle”: There will be fraud eventually if 3 elements are present: Financial Pressure, Rationalization, and Opportunity. The element that employers have control over is Opportunity—which outsourcing helps eliminate.

Performance Audits

Our auditing process is thorough and detailed, providing you with valuable insights to enhance your financial operations. We work closely with you to address any issues and implement solutions for better financial management.

Compliance Audits

Our team of auditors is dedicated to ensuring the integrity of your financial information. We conduct audits with precision and care, offering valuable recommendations for improvement.

Internal Audits

Internal audits are essential for identifying risks and improving operational efficiency. We help you streamline your processes and enhance controls to protect your assets and reduce vulnerabilities.

Tax Planning & Compliance

Why outsource your tax planning and compliance?

You are not a Certified Public Accountant. Tax laws change often and are complicated. Outsource to STRIV who are proactive experts at entrepreneurial taxation and know the aggressive strategies to take to mitigate your tax burden.

As your income goes up, your tax burden grows at an increasing rate, since federal income tax bracket percentages increase from 0 to 37%. Even small tax planning adjustments can generate significant tax savings. Those tax savings increase as you your tax rate increases.